Building wealth often feels like a game rigged for the ultra-rich. The headlines are dominated by billionaires launching rockets or tech moguls buying islands, while the average American is trying to figure out how to pay for groceries and still save for a rainy day. But wealth isn’t just about private jets; it’s about freedom, security, and choices.

For middle-income earners, the path to financial independence doesn’t require a lottery win or an inheritance. It requires strategy. It is about making small, consistent moves that compound over time. The “secret” isn’t a hot stock tip—it’s the boring, reliable work of spending less than you earn and investing the difference wisely.

This guide breaks down actionable, realistic strategies for building wealth on a middle-class income. We will move past the jargon and focus on the behaviors and tools that actually move the needle.

What Does Wealth Building Mean for Middle-Income Earners?

When we talk about wealth, it is easy to confuse it with income. You might see a neighbor driving a luxury car and assume they are wealthy. In reality, they might just have a high income—or worse, high debt.

Net worth vs. income

Income is what comes in every month; wealth (or net worth) is what stays. Your net worth is calculated by taking everything you own (assets like cash, investments, home equity) and subtracting everything you owe (liabilities like mortgages, student loans, credit card debt). A person earning $50,000 who saves $10,000 a year is building wealth faster than a person earning $150,000 who spends $155,000 a year.

Long-term mindset over quick wins

For the middle class, wealth building is a marathon. It is rarely about hitting a home run on a speculative crypto coin. It is about base hits. It involves shifting your mindset from “How can I afford this payment?” to “How will this purchase affect my future freedom?”

Why Wealth Building Is Challenging for Middle-Income Households

If it were easy, everyone would do it. There are structural and psychological hurdles that make saving difficult for the average household.

Cost of living pressures

Housing, healthcare, and education costs have risen significantly faster than wages over the last few decades. When essentials eat up 70% or more of your paycheck, finding that “surplus” to invest feels impossible.

Lifestyle inflation

This is the silent wealth killer. As your career progresses and you get a raise, your spending tends to rise to meet it. You upgrade the car, move to a slightly nicer apartment, or start eating out more. Consequently, your savings rate stays flat even though your income grew.

Limited surplus income

Unlike high earners who might have 50% of their income available for discretionary use, middle-income earners might only have a 5% to 10% margin. One unexpected car repair or medical bill can wipe out months of progress, making it hard to maintain momentum.

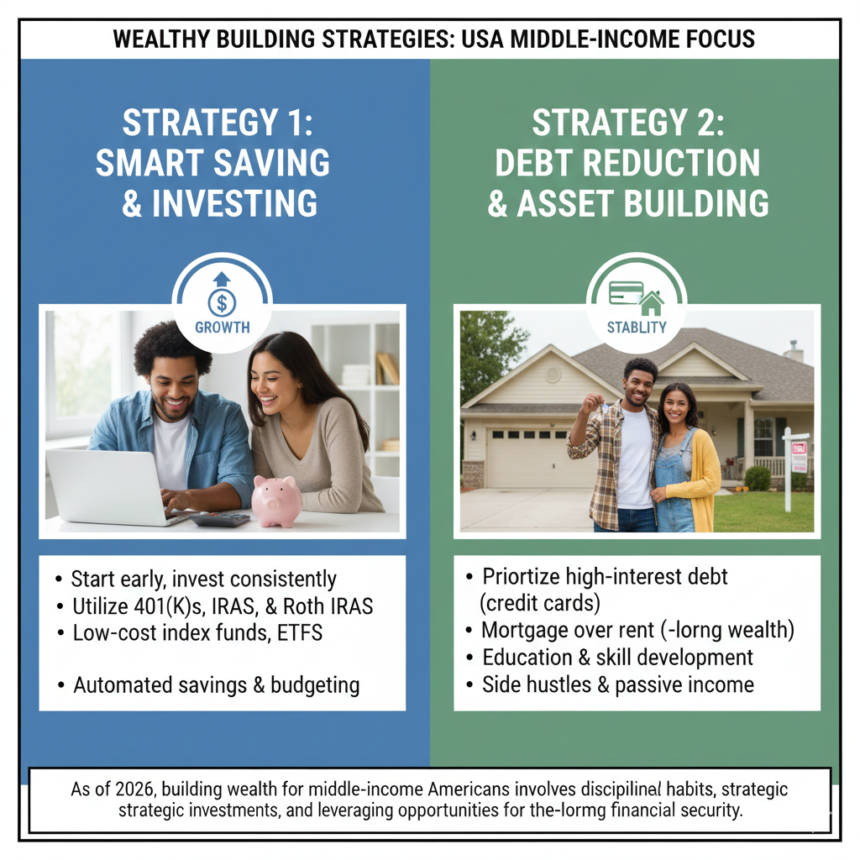

Core Wealth Building Strategies

Despite the challenges, the formula for wealth remains consistent. It comes down to three levers: saving, investing, and managing debt.

Consistent Saving Habits

Pay-yourself-first approach

Most people pay their bills, buy their groceries, go out for drinks, and then save whatever is left over. Usually, nothing is left over. To build wealth, you must flip the equation. As soon as your paycheck hits, transfer a set amount to savings before you pay a single bill. Treat your savings like a non-negotiable expense, just like your rent or mortgage.

Emergency fund importance

You cannot build wealth on a shaky foundation. An emergency fund covering 3 to 6 months of expenses prevents you from raiding your retirement accounts or using credit cards when life happens. If the water heater breaks, it’s an inconvenience, not a financial disaster.

Smart Investing for Growth

Retirement accounts (401(k), IRA)

Your greatest ally is tax-advantaged accounts. If your employer offers a 401(k), use it. An IRA (Individual Retirement Account) is another excellent vehicle. The money grows tax-free or tax-deferred, which accelerates the compounding process.

Index funds and diversification

You don’t need to be a stock picker. In fact, most professionals fail to beat the market over the long term. For most middle-income investors, low-cost index funds (which track the performance of the whole market, like the S&P 500) are the most effective tool. They offer instant diversification, meaning you aren’t reliant on the success of a single company.

Debt Management and Reduction

High-interest debt prioritization

Credit card debt is an emergency. If you are paying 20% interest on a card, there is no investment in the world that will guarantee you a better return than simply paying that off. Attack high-interest debt aggressively before focusing heavily on investing.

Good debt vs. bad debt

Not all debt is created equal. “Bad debt” (credit cards, personal loans for vacations) drains your wealth. “Good debt” (a reasonable mortgage, student loans for a high-ROI degree) can help you build assets or increase earning potential.

Using Employer Benefits to Build Wealth

You might be leaving thousands of dollars on the table by ignoring your HR handbook.

Employer retirement matching

This is free money. If your employer matches 50% of your 401(k) contributions up to 6% of your salary, that is an immediate, guaranteed 50% return on your investment. No stock market wizardry can beat that. Always contribute enough to get the full match.

Health Savings Accounts (HSAs)

If you have a high-deductible health plan, an HSA is a triple-tax threat: contributions are tax-deductible, growth is tax-free, and withdrawals for medical expenses are tax-free. Many people use HSAs as a stealth retirement account, investing the funds for decades.

Budgeting for Wealth, Not Just Expenses

Budgets shouldn’t feel like a punishment; they are a roadmap.

Zero-based and values-based budgeting

In zero-based budgeting, every dollar has a job. Whether it goes to rent, savings, or fun, you assign it a place. Values-based budgeting asks you to cut ruthlessly on things you don’t care about (maybe cable TV or brand-name clothes) so you can spend lavishly on things you do love (like travel or hobbies), all while hitting your savings goals.

Automating savings and investments

Willpower is a finite resource. If you have to manually decide to save money every month, you will eventually fail. Set up automatic transfers from your checking account to your investment accounts. When the decision is made automatically, you learn to live on what remains in your checking account.

Increasing Income Strategically

There is a limit to how much you can cut from your budget, but there is no limit to how much you can earn.

Skill development and career growth

Your greatest asset is your ability to earn an income. Negotiating a 10% raise or switching jobs for a 20% bump can do more for your wealth than skipping lattes for ten years. Invest in certifications or courses that make you more valuable to your employer.

Side income with long-term potential

Gig work is fine for quick cash, but the best side hustles are scalable. Can you start a freelance business? Create a digital product? Rent out a room? Look for income streams that aren’t strictly tied to trading hours for dollars.

Homeownership and Wealth Building

For generations, buying a home was the primary way Americans built wealth. It is still powerful, but it requires math, not just emotion.

Equity vs. renting considerations

Homeownership acts as a “forced savings account.” Every month, part of your mortgage payment pays down the principal, building equity. However, renting offers flexibility. If renting is significantly cheaper than buying in your area, you can still build wealth by investing the difference in the stock market.

Long-term ownership costs

Houses break. Roofs leak. Taxes rise. When calculating if you can afford a home, you must factor in maintenance (usually 1% of the home value per year), insurance, and property taxes. A home is a liability that eventually becomes an asset; make sure you can afford the liability phase.

Tax-Efficient Wealth Strategies

It’s not just what you earn; it’s what you keep.

Tax-advantaged accounts

We mentioned 401(k)s and IRAs, but understanding the difference between Roth and Traditional accounts is key. A Roth IRA uses post-tax dollars, meaning you pay taxes now but withdraw tax-free in retirement. If you expect taxes to be higher in the future, a Roth is a powerful shield.

Basic tax planning principles

You don’t need to be a CPA, but you should understand how capital gains taxes work. Holding an investment for over a year usually qualifies you for lower long-term capital gains tax rates. Frequent trading often triggers higher taxes.

Avoiding Common Wealth-Building Mistakes

The road to wealth is paved with good intentions and bad execution.

Market timing

Trying to buy low and sell high usually results in buying high and selling low. Missing just the 10 best days in the market over a 20-year period can cut your returns in half. Time in the market beats timing the market.

Overconcentration of assets

Don’t put all your eggs in one basket. If your entire net worth is tied up in your company’s stock or a single rental property, you are exposed to massive risk. Diversification is the only free lunch in investing.

Lifestyle creep

We touched on this earlier, but it bears repeating. Every time you get a bonus or a tax refund, bank it. Don’t upgrade your lifestyle until your assets can pay for the upgrade.

Long-Term Wealth vs. Short-Term Consumption

Delayed gratification

This is the psychological superpower of the wealthy. It is the ability to say “no” to the new iPhone today so you can say “yes” to early retirement in 15 years.

Compounding benefits

Compound interest is the eighth wonder of the world.

- Example: If you invest $500 a month starting at age 25, assuming an 8% return, you’ll have over $1.7 million by age 65.

- If you wait until age 35 to start, you’d need to invest over $1,100 a month to reach the same number.

Time does the heavy lifting.

Building Wealth Without Extreme Sacrifice

You don’t have to live on rice and beans in a dark room to get rich.

Sustainable habits

Crash diets don’t work, and neither do crash budgets. If your budget makes you miserable, you will quit. Build a “fun fund” into your budget.

Balanced lifestyle approach

Money is a tool to enjoy life, not just hoard. The goal is to find the sweet spot where you are saving enough to secure your future but spending enough to enjoy your present.

How Long It Takes to Build Wealth

Realistic timelines

Building significant wealth on a middle income takes time. It is measured in decades, not months. The “boring middle” phase—where you are investing for years but not seeing huge results yet—is where most people give up.

Power of consistency

Consistency beats intensity. Saving $200 every single month for 30 years is better than saving $5,000 once and then forgetting about it. Just keep showing up.

Begin Your Journey Today

Wealth building for the middle class is not a mystery. It is a series of small, repeatable choices. It’s checking your spending, automating your savings, and letting time work its magic. The best time to start was ten years ago. The second best time is today. Open that IRA. Set up that auto-transfer. Your future self is waiting to thank you.

FAQs – Wealth Building for Middle-Income Americans

Can middle-income earners really build wealth?

Absolutely. While high earners have a larger shovel, middle-income earners can build substantial wealth through high savings rates, prudent investing, and avoiding debt. Consistency over time matters more than a massive salary.

How much should I invest each month?

A common rule of thumb is 15% to 20% of your gross income. However, start where you can. Even 1% or $50 a month establishes the habit. Increase the percentage every time you get a raise.

Is investing risky for middle-income households?

Investing carries risk, but not investing carries the risk of inflation eroding your purchasing power. Diversified index funds spread risk across thousands of companies, making them a safer bet for long-term growth than picking individual stocks.

Should I pay off debt or invest first?

Generally, prioritize high-interest debt (like credit cards over 7%) first. For lower-interest debt (like a 4% mortgage), it usually makes more mathematical sense to invest, as market returns often average 7-10% over the long run.

What’s the biggest wealth mistake to avoid?

Waiting to start. Many people think they need to wait until they earn more money or know more about the stock market. Every year you wait reduces the power of compound interest. Start messy, but start now.

Leave a Reply