Have you noticed how rarely you visit the ATM these days? You aren’t alone. Walking into a coffee shop and paying with a quick tap of your phone or watch has become second nature for millions of Americans. The days of fumbling for exact change or worrying if you have enough bills in your wallet are fading fast.

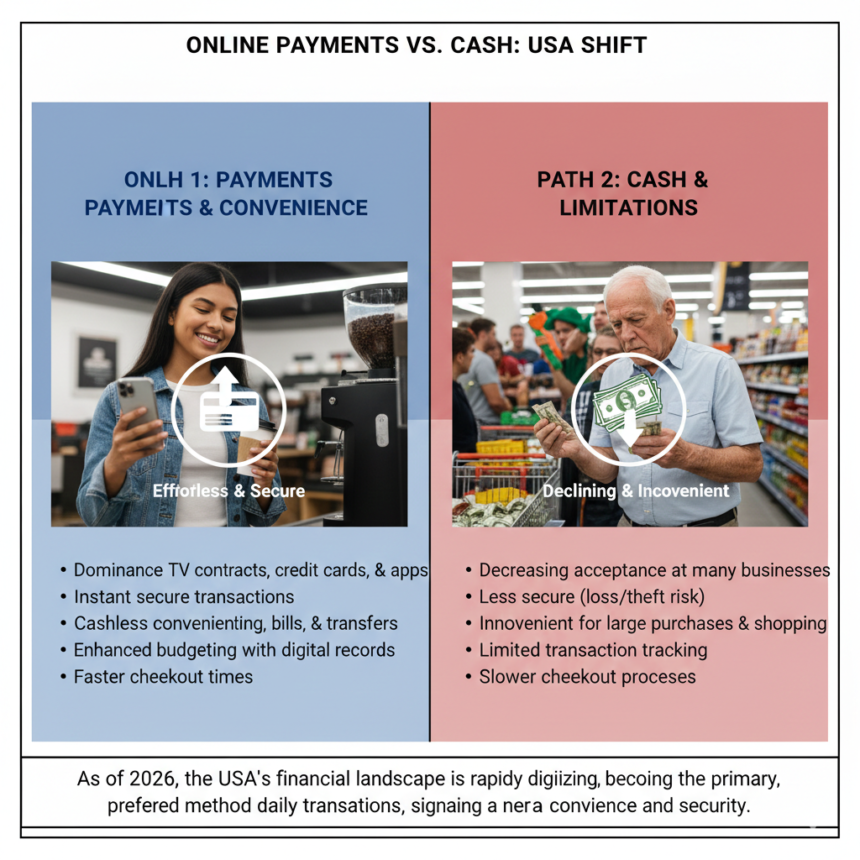

We are witnessing a massive shift in how money moves. While cash was once king, digital transactions have taken the throne, driven by the need for speed, security, and convenience. This transition isn’t just about technology; it’s a fundamental change in consumer behavior and business operations across the United States.

This guide explores the decline of physical currency, the rise of digital wallets, and what a cashless future might look like for you and the economy.

Why Cash Usage Is Declining in the USA

The decline of cash hasn’t happened overnight, but the pace has accelerated dramatically in recent years. The primary driver is convenience. Digital payments remove friction from the buying process. There is no need to count bills, wait for change, or make trips to the bank.

Consumer habits have also shifted. Younger generations, particularly Gen Z and Millennials, treat their smartphones as their primary tool for daily life. When your phone can unlock your car, board your flight, and verify your identity, using it to buy groceries feels like a natural progression.

Furthermore, the COVID-19 pandemic acted as a catalyst. Hygiene concerns made contactless payments a necessity rather than a luxury. Many businesses that were previously “cash only” switched to digital systems to survive, and most never switched back.

What Are Online Payments?

At its simplest level, an online payment is the exchange of value through digital means rather than physical currency. This includes everything from buying a pair of shoes on a website to tapping your credit card at a grocery store terminal.

Online vs. Traditional Payment Methods

Traditional methods rely on physical tokens of value (coins and paper bills) or physical instructions to transfer value (paper checks). These methods are tangible but slow. Online payments, conversely, are digital instructions sent instantly over secure networks. The money moves from your account to the merchant’s account electronically, often in seconds.

Key Online Payment Methods Replacing Cash

Several digital contenders are vying for the spot in your pocket—or rather, your digital wallet. Here are the main players reshaping the landscape.

Credit and Debit Cards

While not new, plastic cards have evolved. The magnetic stripe is largely a relic of the past, replaced by EMV chips and NFC (Near Field Communication) technology. Contactless “tap-to-pay” has surged in popularity because it is significantly faster than inserting a chip. It bridges the gap between physical retail and the speed of digital transactions.

Mobile Wallets

Mobile wallets like Apple Pay, Google Pay, and Samsung Pay are perhaps the biggest threat to cash. By storing card information securely on a smartphone or smartwatch, these apps allow users to pay without ever opening a physical wallet. Adoption rates are skyrocketing because they offer convenience combined with robust security features, like biometric authentication (FaceID or fingerprint scanning).

Peer-to-Peer (P2P) Payment Apps

Remember when splitting a dinner bill involved complicated math and collecting stacks of crinkled dollar bills? P2P apps like Venmo, Cash App, and Zelle have solved this. These apps allow friends and family to send money to each other instantly. They have become so integrated into culture that “Venmo” is now used as a verb.

Buy Now, Pay Later (BNPL)

BNPL services like Affirm, Afterpay, and Klarna offer a modern twist on the old layaway model. Instead of waiting to pay off an item before taking it home, you get the item immediately and pay for it in short-term installments, often interest-free. This has become a preferred payment method for online shopping, particularly for clothing and electronics.

How Businesses Are Adopting Cashless Payments

It isn’t just consumers driving this change; businesses prefer digital too. In the food service industry, from fast-casual chains to food trucks, cashless kiosks and tablet-based registers are the new standard. They speed up lines and reduce errors.

For small businesses, tools like Square and Toast have leveled the playing field. A farmer at a local market can now accept credit cards and Apple Pay just as easily as a major retailer. These digital tools also integrate with inventory and accounting software, making the “business” side of running a shop much easier than managing a cash drawer.

Role of Smartphones and Technology

The smartphone is the engine of the cashless revolution. Technologies like NFC allow your phone to talk to payment terminals wirelessly. QR codes, which saw a massive resurgence during the pandemic, allow for touch-free payments at restaurants and parking meters.

App-based checkout experiences have also changed retail. Think about the Starbucks app or ordering ahead at Chipotle. You order and pay on your phone, then walk in and grab your items without ever standing in line or opening your wallet. This seamless integration of ordering and payment is something cash simply cannot compete with.

Security and Fraud Protection

One common worry about ditching cash is security. However, digital payments are often safer than carrying a wad of bills.

Encryption and Tokenization

When you use a mobile wallet or a chip card, your actual card number isn’t shared with the merchant. Instead, the system uses “tokenization.” This replaces your sensitive data with a unique, one-time code (a token) for that specific transaction. Even if hackers steal the merchant’s data, the tokens they find are useless.

Consumer Trust and Protections

Credit cards and reputable payment apps offer fraud protection. If someone steals your cash, it is gone forever. If someone makes a fraudulent charge on your card, you can dispute it and usually get your money back. This layer of financial safety builds trust and encourages more people to move away from paper money.

Benefits of Online Payments Over Cash

Why are we making this switch? The benefits are tangible.

- Speed and Convenience: Tapping a phone takes a second. Counting change takes significantly longer. In a busy world, those saved seconds add up.

- Transaction Tracking: Digital payments leave a digital trail. You can open your banking app and see exactly where you spent money, down to the cent. This automatic record-keeping is invaluable for budgeting.

- Reduced Handling Costs: For businesses, handling cash is expensive. It requires time to count, secure transport to the bank, and insurance against theft. Digital payments eliminate these physical logistics.

Challenges of a Cashless Society

Despite the benefits, moving to a fully cashless society brings significant challenges that cannot be ignored.

Privacy Concerns

Cash is anonymous. When you buy a coffee with a five-dollar bill, no data is collected. Digital transactions create a permanent record of your purchasing habits. Data privacy advocates worry about how corporations and governments might use this vast amount of personal financial data.

Accessibility and the Digital Divide

Not everyone has a smartphone or a bank account. The “unbanked” or “underbanked” population in the USA relies on cash. Moving to a fully cashless system risks excluding millions of people—often the elderly or those with lower incomes—from participating in the economy.

System Outages and Reliable Infrastructure

Cash works when the power goes out. Digital payments do not. If a cellular network crashes or a bank’s system goes offline, commerce can grind to a halt. Reliance on digital infrastructure creates vulnerability to technical glitches and cyberattacks.

Impact on Consumers in the USA

The shift to digital impacts how we think about money. Behavioral economists have found that the “pain of paying” is lower with cards and phones than with cash. Handing over a physical bill feels like a loss; tapping a screen feels abstract.

This can lead to changes in spending behavior, sometimes resulting in impulse buying. However, it also offers better financial visibility. Budgeting apps can connect directly to your accounts, categorizing your spending automatically and helping you manage your finances more effectively than a paper ledger ever could.

Impact on Businesses and the Economy

For the broader economy, digital payments lubricate the gears of commerce. Faster transactions mean higher customer throughput.

Data insights are another game-changer. Businesses can analyze purchasing trends in real-time. A coffee shop knows instantly that oat milk lattes are trending on Tuesday mornings and can adjust inventory accordingly. This efficiency boosts profitability and reduces waste.

Online Payments and Financial Inclusion

Fintech (financial technology) has a dual nature regarding inclusion. On one hand, mobile banking apps have made it easier for people in remote areas to access financial services without needing a physical bank branch.

On the other hand, a cashless society poses risks. Cities like Philadelphia, New York City, and San Francisco have passed laws requiring brick-and-mortar stores to accept cash to prevent discrimination against those who lack access to digital payment methods.

Future of Payments in the USA

Where do we go from here? The future looks even more integrated.

Biometric and Instant Payments

We are moving toward biometric payments—paying with a scan of your palm or iris. Amazon One palm scanners are already in use at Whole Foods. Additionally, the U.S. Federal Reserve recently launched “FedNow,” a service designed to make instant payments available around the clock, 365 days a year, making bank transfers as fast as handing someone a twenty-dollar bill.

Central Bank Digital Currency (CBDC)

There are ongoing discussions about a digital dollar—a Central Bank Digital Currency. This would be a digital form of cash issued by the Federal Reserve, distinct from the decentralized cryptocurrencies like Bitcoin. While still in the research phase, a U.S. CBDC could fundamentally change how money is issued and tracked.

FAQs – Online Payments vs Cash

Are online payments safer than cash?

Generally, yes. While cybercrime is a risk, modern encryption and fraud protection policies make digital payments very secure. If you lose cash, it is gone. If digital funds are stolen, banks often reimburse the loss.

Will cash disappear completely in the USA?

It is unlikely to disappear completely in the near future. While its usage is dropping, cash remains essential for emergency situations, small person-to-person transactions, and for unbanked populations.

What payment method is most popular in the USA?

Credit and debit cards currently hold the top spot, but mobile wallets (like Apple Pay) are the fastest-growing category.

Do online payments increase spending?

Studies suggest that people tend to spend more when using non-cash methods because the psychological “pain of paying” is reduced.

What happens during payment system outages?

If the internet or card processing networks go down, businesses cannot accept digital payments. This is why many experts recommend keeping a small amount of emergency cash on hand.

Embracing a Digital Wallet

The transition away from cash is more than a trend; it is a structural shift in the American economy. While we may never see paper money vanish entirely, its role is diminishing. For consumers, the future offers incredible convenience and security, provided we navigate the privacy and accessibility challenges with care. So, the next time you leave the house, don’t panic if you forget your wallet—as long as you have your phone, you’re ready to pay.

Leave a Reply