We often hear about the “strength” of the dollar on the nightly news, usually framed in the context of stock markets or international trade deals. But for the average American daydreaming about a summer in Tuscany or a winter getaway to Tokyo, those fluctuating numbers on a currency ticker mean something much more tangible: how far your paycheck will stretch when you land.

Travel is one of the most rewarding investments we make in ourselves, yet the financial logistics can feel murky. You budget for the flight and the hotel, but the daily reality of spending money abroad is dictated by the invisible hand of exchange rates. A shift of a few percentage points might seem negligible on paper, but over a two-week trip, it can be the difference between a prix-fixe dinner and a grab-and-go sandwich.

Understanding how currency values impact your travel costs isn’t just about saving a few cents; it’s about empowerment. It’s about knowing when to book, where to go, and how to make your hard-earned money deliver the experiences you’ve been dreaming of.

What Are Exchange Rates?

At its core, an exchange rate is simply the price of one currency expressed in terms of another. It answers the question: “How many euros can I buy with one U.S. dollar?” If the rate is 1 USD to 0.90 EUR, your dollar gets you 90 euro cents. If it shifts to 1 USD to 0.95 EUR, your dollar has become “stronger”—it now buys more foreign currency.

These values are never static. They fluctuate based on a complex web of factors including inflation, interest rates, political stability, and economic performance. While day traders watch these shifts second-by-second, travelers usually feel the impact over months or years. A destination that was affordable three years ago might be pricey today solely because the local currency gained value against the dollar.

Why Exchange Rates Matter for U.S. Travelers

For Americans, the exchange rate is the silent partner in every travel transaction. It determines your purchasing power abroad. When the dollar is strong, the world effectively goes on sale. You might find that a luxury hotel in Mexico or a rail pass in Japan costs significantly less in USD terms than it did the year prior.

Conversely, budget predictability becomes difficult when rates are volatile. If you book a trip six months in advance, a sudden drop in the dollar’s value could mean your on-the-ground costs—meals, train tickets, museum entries—are 10% or 15% more expensive than you originally calculated. Being aware of these trends helps you build a buffer into your budget so you aren’t caught off guard by a credit card bill that’s higher than expected.

How Exchange Rates Affect Travel Costs

The impact of currency fluctuation touches almost every aspect of a trip, but it hits some categories harder than others.

Flights and Transportation

Airline pricing is a complex beast, but exchange rates play a role, particularly regarding fuel costs. Since oil is priced in U.S. dollars globally, a strong dollar can theoretically help stabilize fuel costs for U.S. carriers. However, for international routes, the purchasing power of the local population at the destination also matters. If the dollar is very strong, it might dampen demand from foreign travelers coming to the U.S., potentially prompting airlines to adjust prices to fill seats. Generally, domestic routes are less directly affected by daily currency shifts, but international fares can swing based on the economic health of the destination country.

Hotels and Accommodations

This is where travelers often feel the sharpest difference. Hotels are usually priced in local currency. If you book a room in London for £200 a night, the amount that leaves your U.S. bank account depends entirely on the exchange rate at the time of payment.

In a “luxury vs. budget” context, a favorable exchange rate can allow you to upgrade your lifestyle. A strong dollar might mean the difference between a standard room and a suite, or staying in the city center versus a suburb. Conversely, a weak dollar might force you to downsize your accommodation expectations to keep the total trip cost viable.

Food, Shopping, and Activities

Daily spending power is the steady drip of expenses that defines a trip. A coffee in Paris, a leather bag in Florence, a snorkeling tour in Thailand—these are instantaneous transactions. When the exchange rate is poor, you might find yourself constantly doing mental math and feeling guilty about small purchases. When the rate is good, that mental load vanishes. You feel richer because, functionally, you are.

This impact is often felt less in tourist-heavy areas where prices are artificially inflated anyway, but in local neighborhoods, the raw power of the exchange rate shines through.

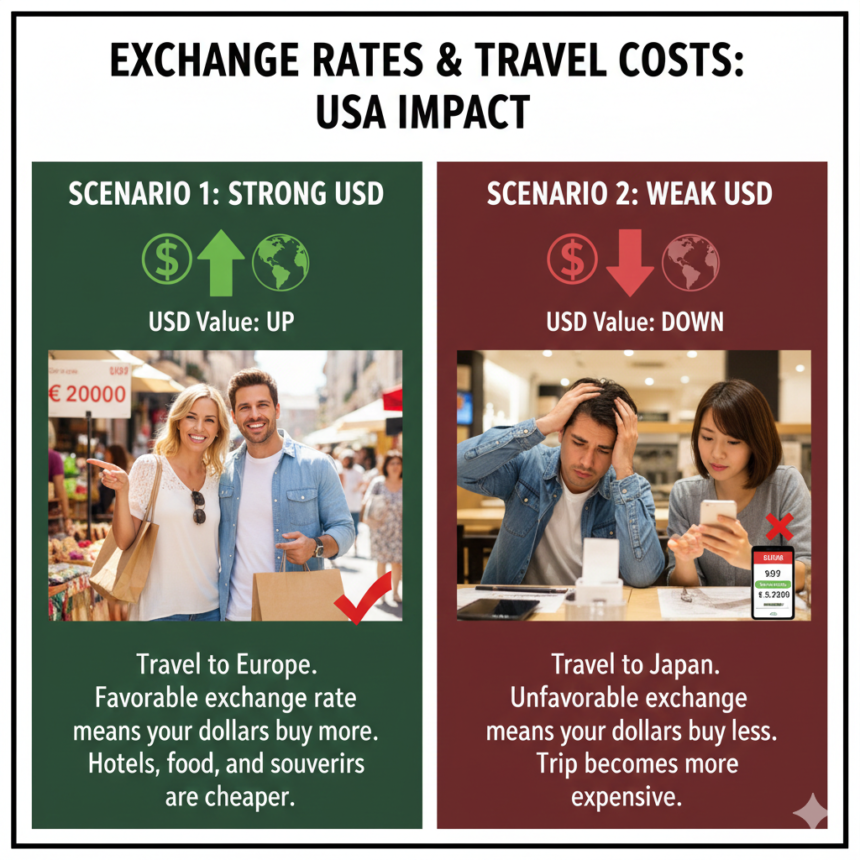

Strong Dollar vs Weak Dollar Scenarios

Travelers need to adopt different mindsets depending on the economic climate.

Benefits of a Strong USD

When the dollar is strong, American travelers are king. This scenario opens up “reach” destinations—places like Switzerland, the UK, or Scandinavia that are notoriously expensive. A strong dollar acts as a discount coupon for the entire country. It’s the ideal time to make big-ticket purchases, buy foreign luxury goods, or extend your stay because your daily burn rate is lower.

Challenges When the Dollar Weakens

When the dollar weakens, travel to Europe or other strong-currency zones becomes painful. Your budget tightens, and you get less bang for your buck. This scenario often forces travelers to be more creative. It might mean swapping a trip to France for a trip to Vietnam or Colombia, where the cost of living is lower relative to the U.S., offsetting the weaker dollar. It discourages impulse spending and requires stricter adherence to a daily budget.

Exchange Rates and Popular Destinations for Americans

The relationship between the USD and other major currencies dictates travel trends.

Europe

The Euro (EUR) and British Pound (GBP) are the traditional benchmarks. For decades, London and Paris were seen as expensive cities. However, in recent years, periods of parity between the USD and Euro have led to record numbers of Americans flooding into Italy, Greece, and France, taking advantage of historically cheap prices.

Asia

Currencies in Asia, specifically the Japanese Yen, have seen significant fluctuations. Historically, Tokyo was considered one of the world’s most expensive cities. Recently, the weakening of the Yen against the Dollar turned Japan into a surprisingly affordable destination for Americans, sparking a massive tourism boom.

Latin America

Many Latin American countries have currencies that historically trade lower than the dollar. Places like Mexico, Argentina, and Colombia often provide immense value for U.S. travelers regardless of minor fluctuations. However, high local inflation in some of these countries can sometimes negate the benefit of a favorable exchange rate.

Canada

Our neighbor to the north is a prime example of exchange rate tourism. When the Canadian Dollar (CAD) is weak compared to the USD, U.S. tourists flock across the border for ski trips in Whistler or city breaks in Toronto, effectively getting a 25-30% discount on everything from poutine to hotel rooms.

Hidden Currency Costs Travelers Miss

Even with a great exchange rate, you can lose money if you aren’t paying attention to the mechanics of paying.

Foreign Transaction Fees

Many standard credit cards charge a fee—usually around 3%—on every purchase made outside the U.S. If you spend $3,000 on a trip, that’s $90 wasted on fees. This effectively worsens your exchange rate by 3% on every single swipe.

Poor Exchange Rates at Airports

The currency exchange booths at airports (and often in city centers) are notorious for offering terrible rates. They capitalize on convenience and anxiety. You might see a sign creating a sense of “no fee,” but the fee is baked into a significantly worse exchange rate than you would get from a standard bank ATM.

Dynamic Currency Conversion

This is the most common trap. When you pay for a meal or a souvenir, the card terminal might ask: “Pay in USD or Local Currency?” Always choose local currency. If you choose USD, the merchant’s bank sets the exchange rate, and it is almost guaranteed to be terrible. By choosing local currency, your bank handles the conversion at the market rate, which is far superior.

Best Ways to Manage Exchange Rate Risk

You can’t control the global economy, but you can control how you interact with it.

Using No-Foreign-Fee Cards

This is the lowest-hanging fruit. Before you travel, ensure you have a credit card that waives foreign transaction fees. Travel-specific rewards cards almost always offer this perk. It instantly saves you 3% on your trip.

Timing Currency Exchanges

If you know you are traveling to Europe in six months and the rate is historically excellent today, you could exchange some cash now to “lock in” that rate. However, for most travelers, the fees associated with getting cash often outweigh the benefits of timing the market.

ATM vs Cash Strategies

The golden rule of travel money: The ATM is your friend. Using a debit card at a legitimate bank ATM in your destination usually offers the best possible live market rate. Avoid exchanging cash at hotels or standalone booths. Pull out larger amounts of cash less frequently to minimize ATM withdrawal fees.

Exchange Rates and Travel Planning Decisions

Savvy travelers let the market dictate the map.

Destination Selection

If the dollar is crushing the Yen but struggling against the Swiss Franc, maybe this is the year for Tokyo instead of Zurich. Being flexible with your destination based on currency strength can save you thousands of dollars without sacrificing the quality of your vacation.

Trip Timing and Seasonality

While seasonality (high season vs. low season) affects prices more than currency, combining the two is a power move. Visiting a country with a weak currency during its “shoulder season” (the period between peak and off-peak) results in rock-bottom prices and fewer crowds.

Length of Stay Adjustments

A favorable exchange rate might allow you to extend a 7-day trip to a 10-day trip for the same total cost. Conversely, a weak dollar might mean shortening a trip by a day or two to keep the budget intact.

Impact on Business vs Leisure Travel

The stakes differ depending on who is paying the bill.

Corporate Travel Budgets

For businesses, exchange rates are a line item on a balance sheet. A strong dollar is great for U.S. companies sending employees abroad, as travel budgets stretch further. However, multinational companies have to deal with complex hedging strategies to ensure currency swings don’t eat into quarterly profits.

Expense Reimbursements

For the business traveler, the annoyance often comes during reimbursement. If you paid in Euros on your personal card and are reimbursed in Dollars weeks later, a shift in the rate could technically mean you lose (or gain) a few dollars in the process, though most companies use the rate on the date of the transaction.

Do Exchange Rates Affect Domestic U.S. Travel?

Interestingly, yes. When the dollar is strong, international travel becomes cheaper for Americans, which can actually decrease demand for domestic destinations. Why go to Disney World if a trip to Paris costs roughly the same?

Conversely, when the dollar is strong, it becomes very expensive for foreign tourists to visit the U.S. This drops international demand for places like New York City, Las Vegas, and National Parks. This dip in demand can sometimes lead to domestic price drops or better availability for U.S. residents staying home.

How to Track Exchange Rates Before Traveling

Knowledge is power. Don’t wait until you land to know what your money is worth.

Currency Apps and Alerts

Apps like XE Currency or Oanda allow you to track live rates. You can even set alerts. For example, “Notify me if the USD to EUR rate hits 0.95.” This helps you understand the trend line before you board the plane.

Planning Tools and Calculators

When budgeting, use a currency calculator to estimate costs. Don’t just guess. If a hotel is 20,000 Yen, convert that to USD today to see if it fits your budget. Check it again a week before you travel to ensure nothing drastic has changed.

Plan Smart, Travel Far

Exchange rates are a dry economic concept with vivid, real-world consequences. They decide whether you order the steak or the salad, whether you stay for a week or a fortnight, and sometimes, whether you go at all. By keeping an eye on currency trends and avoiding rookie mistakes like Dynamic Currency Conversion, you can insulate yourself from the worst of the fluctuations and take full advantage of the best of them. The world is waiting—make sure your wallet is ready.

FAQs – Exchange Rates and Travel Costs

Does a strong dollar make travel cheaper?

Yes, generally speaking. When the U.S. dollar is strong, it buys more foreign currency. This means everything from hotels and meals to train tickets and souvenirs costs you less in USD terms than it would if the dollar were weak.

When should I exchange money for a trip?

Ideally, you shouldn’t exchange large amounts of cash before you leave. The best strategy is usually to use your debit card at a local bank ATM upon arrival at your destination. This typically gives you the live market rate, which is far better than the rates offered by your home bank or airport exchange booths.

Are credit cards better than cash abroad?

For most purchases, yes. Credit cards (specifically those with no foreign transaction fees) offer excellent exchange rates and fraud protection. However, you should always carry some local cash for small vendors, tips, and transportation that might not accept cards.

How much do exchange rates change travel budgets?

It depends on the volatility, but a 10% swing is not uncommon over a year. On a $5,000 trip, a 10% unfavorable shift in the exchange rate could effectively cost you an extra $500.

Can exchange rates change after I book a trip?

Yes, but only for things you haven’t paid for yet. If you prepay for your flight and hotel in USD, those costs are locked in. However, your daily spending money (meals, tickets, shopping) will be subject to the exchange rate at the exact moment you swipe your card during the trip.

Leave a Reply